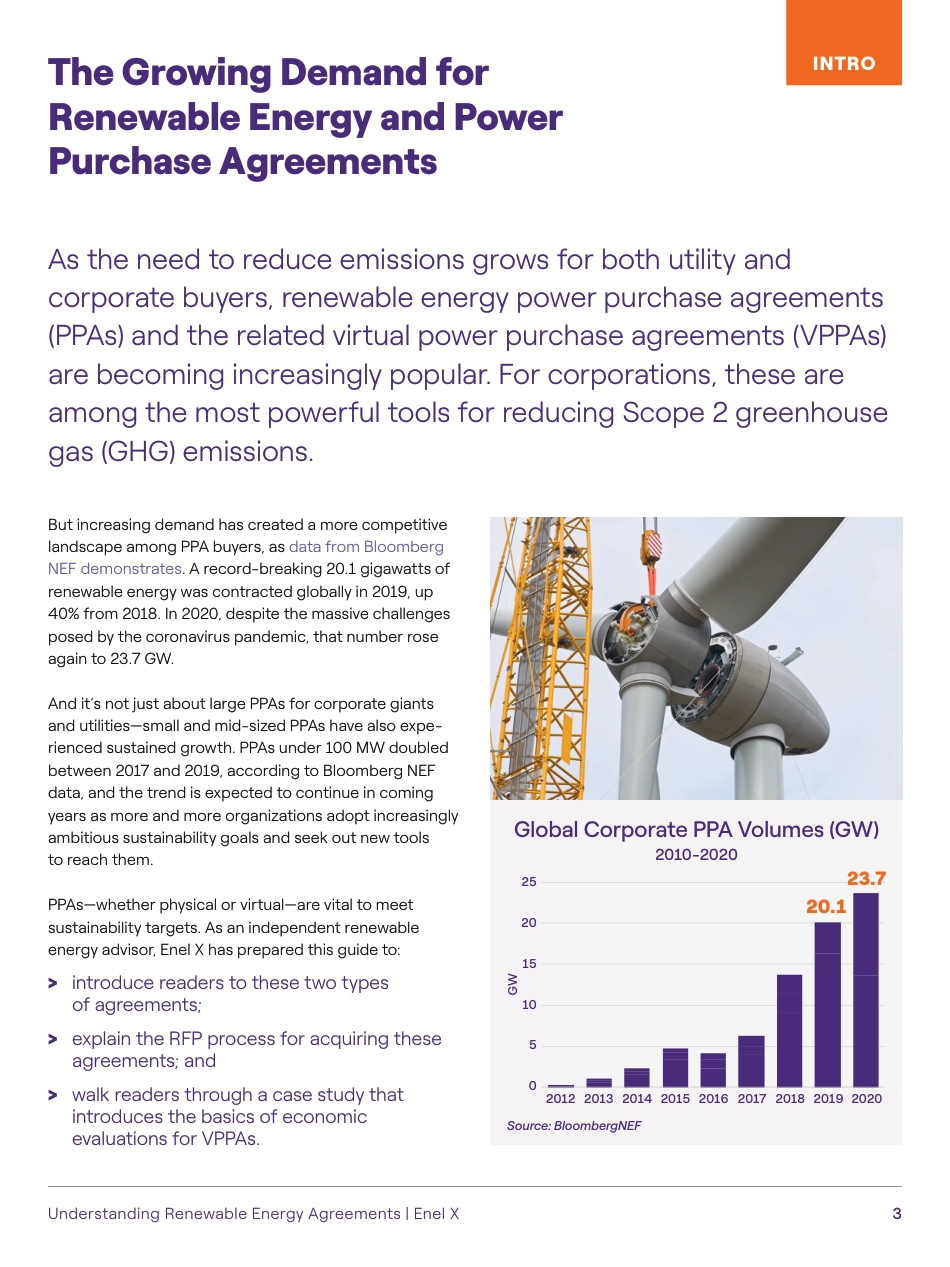

Understanding PPAs and VPPAsHow These Tools Work, and How to Evaluate the Economics of VPPAsUnderstanding Renewable Energy AgreementsHow to Evaluate the Financial and Environmental Implications of PPAs and VPPAs2Understanding Renewable Energy Agreements | Enel XINTRODUCTIONThe Growing Demand for Renewable Energy and Power Purchase AgreementsPART 1Understanding PPA Contract Structures PART 2Understanding VPPA Cash Flows PART 3A Case Study in VPPA SelectionPART 4Best Practices in Soliciting ProposalsCONCLUSIONKey Takeaways for Assessing Value and Risk in PPAs and VPPAsTable of Contents34571214DISCLAIMERTRANSACTIONS IN OVER-THE-COUNTER DERIVATIVES (OR “SWAPS”) HAVE SIGNIFICANT RISKS, INCLUDING, BUT NOT LIMITED TO, SUBSTANTIAL RISK OF LOSS. YOU SHOULD REFRAIN FROM ENTERING INTO ANY SWAP TRANSACTION UNLESS YOU HAVE FULLY UNDERSTOOD THE TERMS AND RISKS OF THE TRANSACTION, INCLUDING THE EXTENT OF YOUR POTENTIAL RISK OF LOSS. FOR FURTHER INFORMATION ABOUT ENEL X NORTH AMERICA, PLEASE VISIT: GENERAL INFORMATION: www.enelx.com/n-a/en | LEGAL INFORMATION: www.enelx.com/n-a/en/legal-statements3Understanding Renewable Energy Agreements | Enel XThe Growing Demand for Renewable Energy and Power Purchase AgreementsAs the need to reduce emissions grows for both utility and corporate buyers, renewable energy power purchase agreements (PPAs) and the related virtual power purchase agreements (VPPAs) are becoming increasingly popular. For corporations, these are among the most powerful tools for reducing Scope 2 greenhouse gas (GHG) emissions.But increasing demand has created a more competitive landscape among PPA buyers, as data from Bloomberg NEF demonstrates. A record-breaking 20.1 gigawatts of renewable energy was contracted globally in 2019, up 40%...