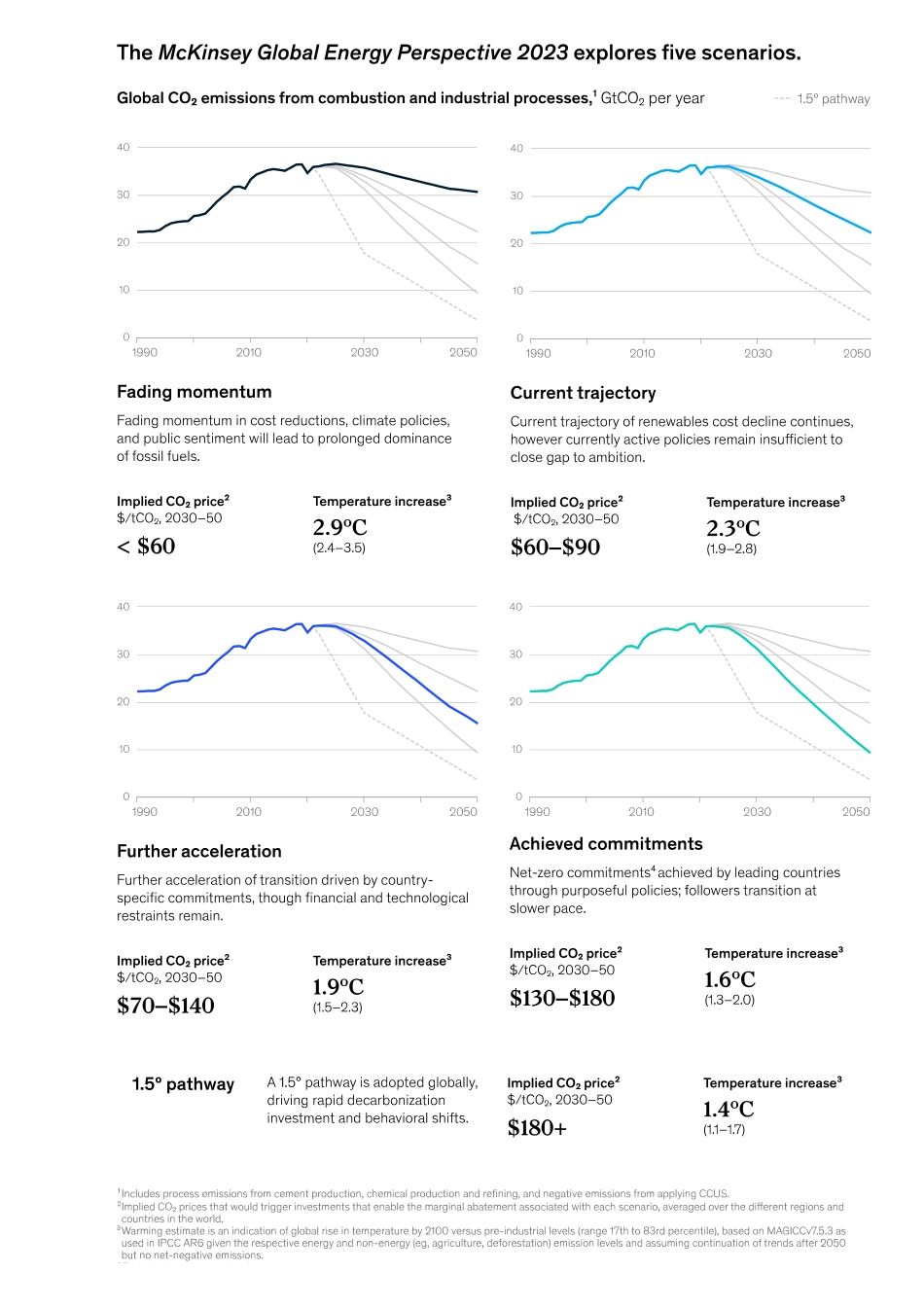

IIn an evolving energy landscape, our Global Energy Perspective 2023 provides insights intolong-term trends that will shape the energy transition.n the past two years, the war in Ukraine and the subsequent energy crisis have changed the energy conversation. Energysecurity, a�ordability, and industrial competitiveness are now critical focus points alongside sustainability.The outlook for the energy transition depends on multiple variables and interdependencies. Uncertainties in cost evolutions,speed of technological progress, and policy developments translate into a wide range of possible scenarios, particularlyregarding the outlook for fossil fuels.What is clear, however, is that the pathway to keep warming below 1.5°C looks increasingly challenging. The world isnonetheless making progress toward a net-zero future, with record growth in areas such as electric vehicle (EV) sales andrenewable energy. By 2040, we expect solar and wind together to contribute the largest share of the world’s energy mix.Substantial investments will be needed to support the build-out of renewal energy—and to provide su�cient fossil fuels tocomplement these sources. We expect total energy investments to increase from 1.5 trillion USD in 2021 to between 2 and 3.2trillion in 2040. While this represents a big increase, investment levels are likely to remain stable as a proportion of GDP.The question now is whether supply chains can keep up with the pace of the energy transition. Materials shortages andproduction bottlenecks—and even land availability—all threaten to slow momentum. These risks play out to varying degrees inevery scenario we model in the latest edition of our Global Energy Perspective.As the world treads a �ne line between...