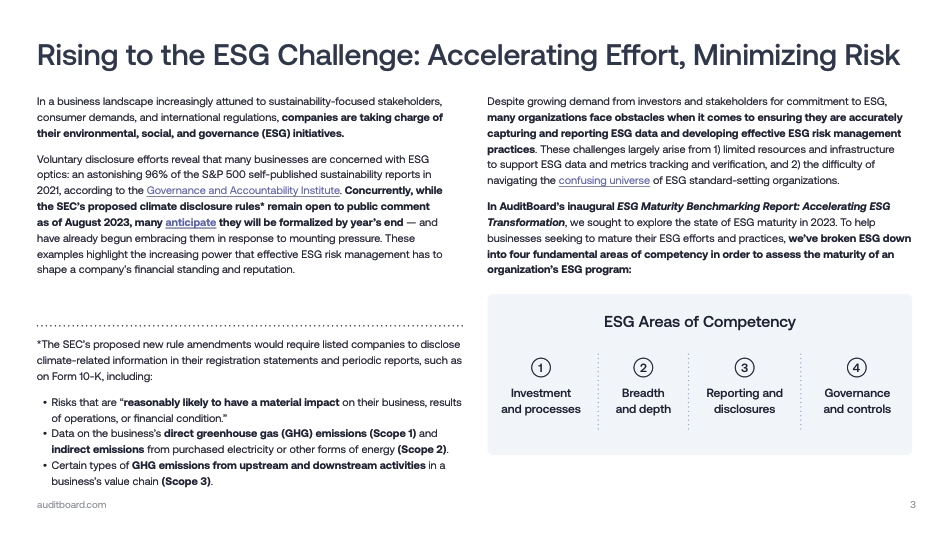

auditboard.com 1auditboard.com 2Table of Contents Rising to the ESG Challenge: Accelerating Effort, Minimizing Risk 3Part One: Key Findings From the 2023 ESG Maturity Benchmarking Report 8Part Two: Five Initiatives to Advance Your ESG Maturity 19There’s No Time Like the Present to Start Maturing Your ESG Practices 22auditboard.com 3Rising to the ESG Challenge: Accelerating Effort, Minimizing RiskIn a business landscape increasingly attuned to sustainability-focused stakeholders, consumer demands, and international regulations, companies are taking charge of their environmental, social, and governance (ESG) initiatives. Voluntary disclosure efforts reveal that many businesses are concerned with ESG optics: an astonishing 96% of the S&P 500 self-published sustainability reports in 2021, according to the Governance and Accountability Institute. Concurrently, while the SEC’s proposed climate disclosure rules* remain open to public comment as of August 2023, many anticipate they will be formalized by year’s end — and have already begun embracing them in response to mounting pressure. These examples highlight the increasing power that effective ESG risk management has to shape a company’s financial standing and reputation. Despite growing demand from investors and stakeholders for commitment to ESG, many organizations face obstacles when it comes to ensuring they are accurately capturing and reporting ESG data and developing effective ESG risk management practices. These challenges largely arise from 1) limited resources and infrastructure to support ESG data and metrics tracking and verification, and 2) the difficulty of navigating the confusing universe of ESG standard-setting organizations. In AuditBoard’s inaugural ESG Mat...