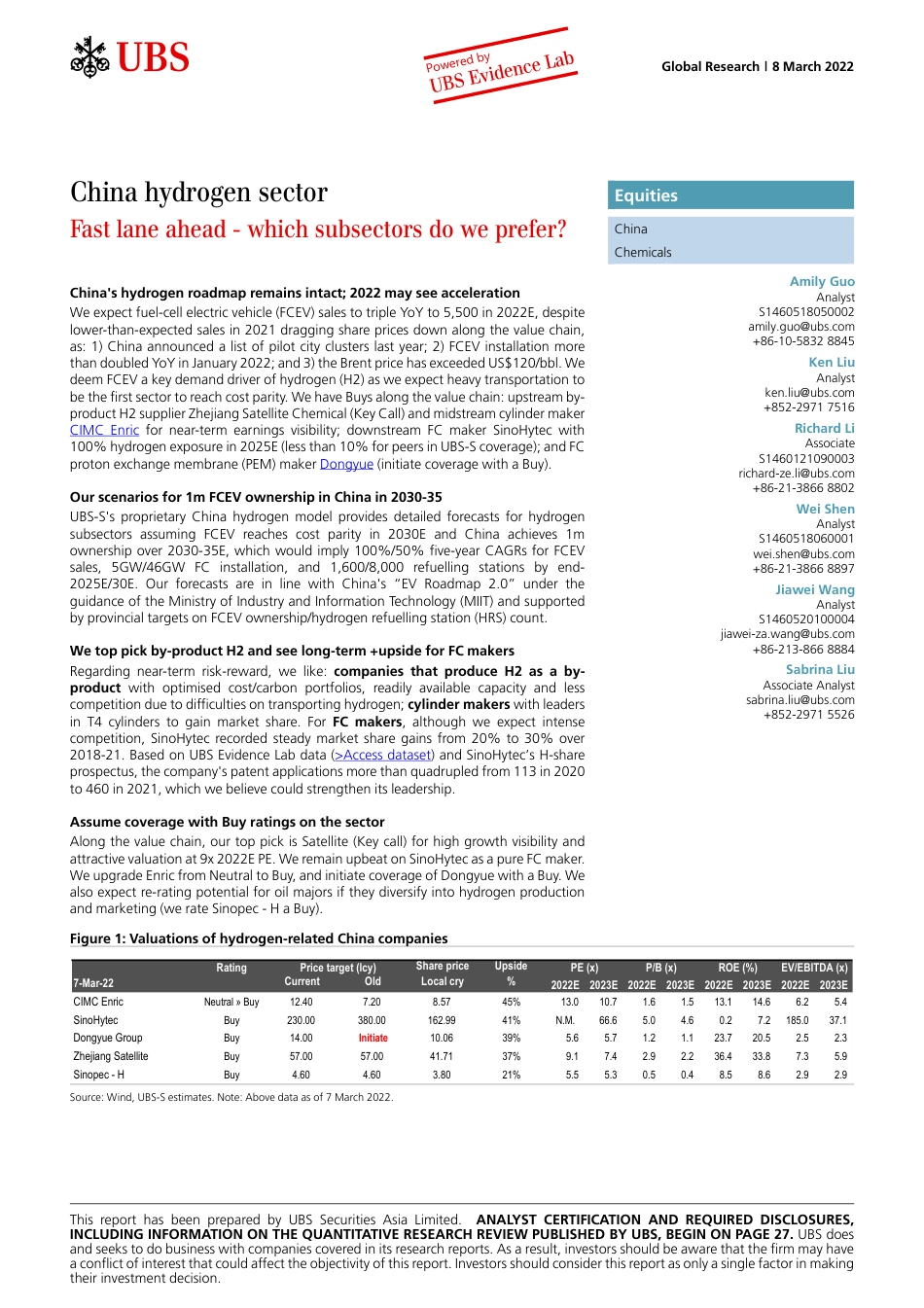

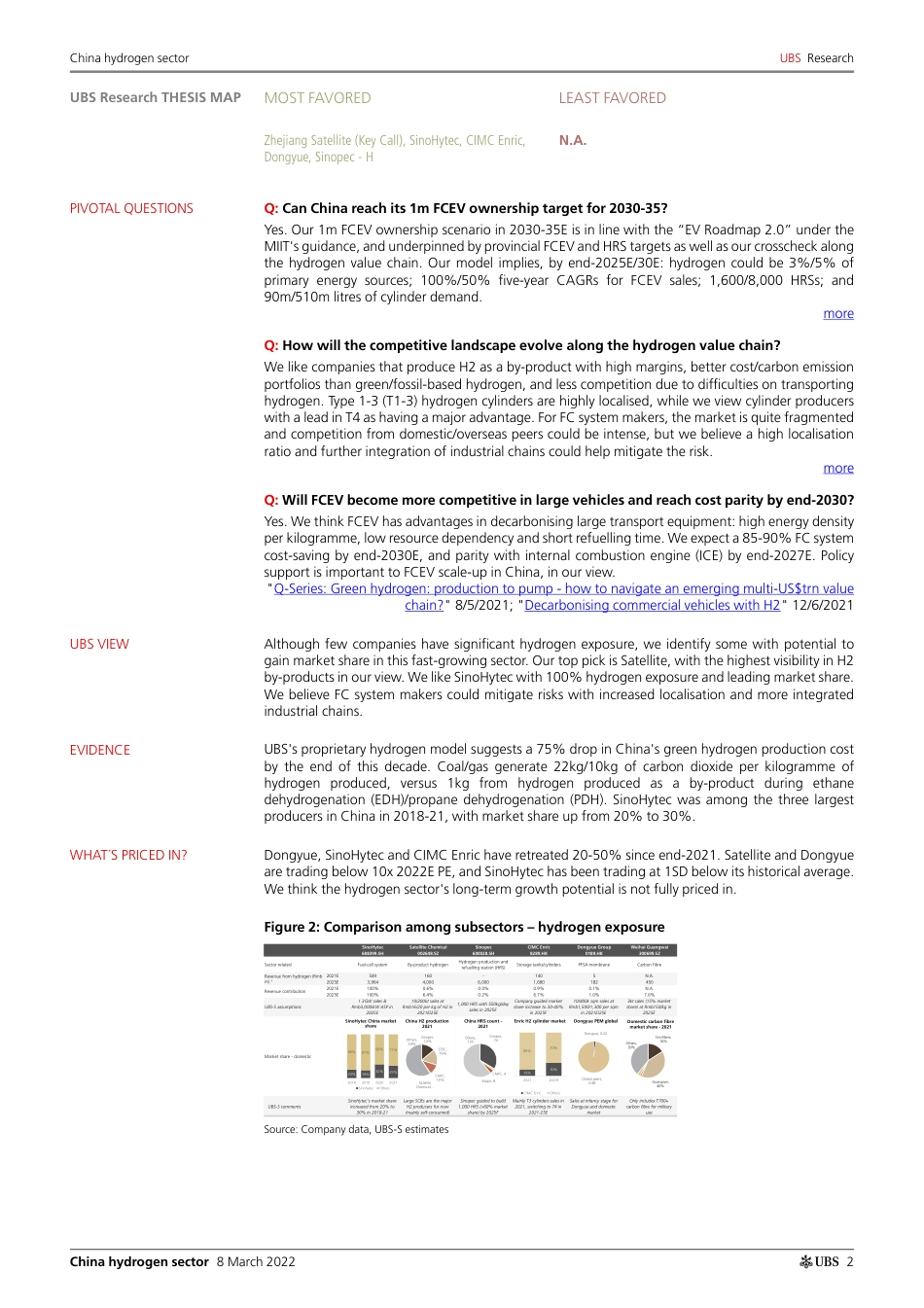

abGlobal Research | 8 March 2022Powered byUBS Evidence LabYESChina's hydrogen roadmap remains intact; 2022 may see accelerationWe expect fuel-cell electric vehicle (FCEV) sales to triple YoY to 5,500 in 2022E, despite lower-than-expected sales in 2021 dragging share prices down along the value chain, as: 1) China announced a list of pilot city clusters last year; 2) FCEV installation more than doubled YoY in January 2022; and 3) the Brent price has exceeded US$120/bbl. We deem FCEV a key demand driver of hydrogen (H2) as we expect heavy transportation to be the first sector to reach cost parity. We have Buys along the value chain: upstream by-product H2 supplier Zhejiang Satellite Chemical (Key Call) and midstream cylinder maker CIMC Enric for near-term earnings visibility; downstream FC maker SinoHytec with 100% hydrogen exposure in 2025E (less than 10% for peers in UBS-S coverage); and FC proton exchange membrane (PEM) maker Dongyue (initiate coverage with a Buy).Our scenarios for 1m FCEV ownership in China in 2030-35UBS-S's proprietary China hydrogen model provides detailed forecasts for hydrogen subsectors assuming FCEV reaches cost parity in 2030E and China achieves 1m ownership over 2030-35E, which would imply 100%/50% five-year CAGRs for FCEV sales, 5GW/46GW FC installation, and 1,600/8,000 refuelling stations by end-2025E/30E. Our forecasts are in line with China's “EV Roadmap 2.0” under the guidance of the Ministry of Industry and Information Technology (MIIT) and supported by provincial targets on FCEV ownership/hydrogen refuelling station (HRS) count. We top pick by-product H2 and see long-term +upside for FC makersRegarding near-term risk-reward, we like: companies that produce H2 as a by-prod...