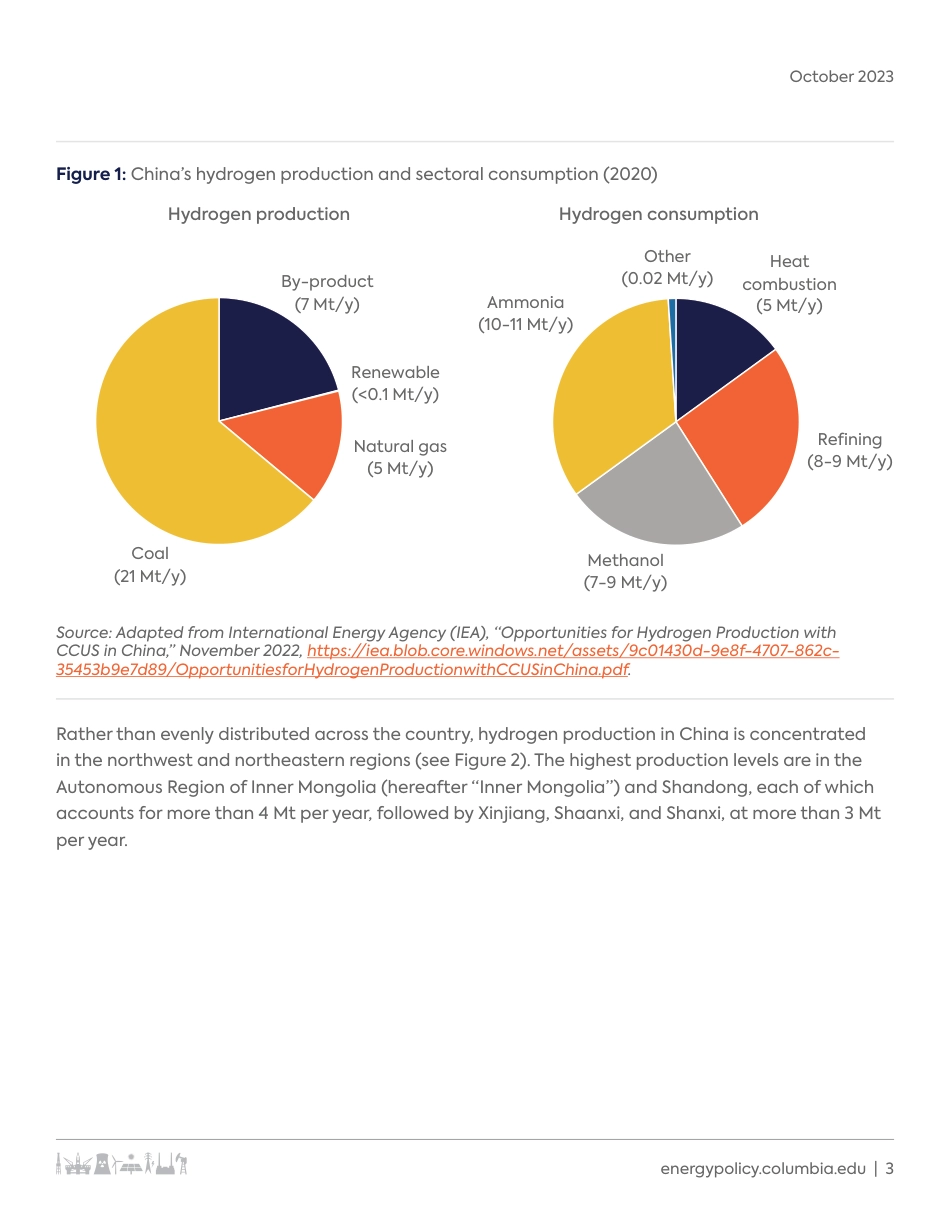

energypolicy.columbia.edu | 1October 2023While the US and European medias have dedicated significant bandwidth to the topic of low-carbon hydrogen in the United States and Europe, they have reported far less on unfolding developments around that topic in China. This disparity is especially notable because China stands as the foremost global player in hydrogen production and consumption.1 The country’s substantial market size and extensive industrial infrastructure not only facilitate fast technological advancements in the hydrogen space, but also offer the potential to achieve economies of scale—two developments that can significantly influence the global hydrogen market landscape. In light of these circumstances, it is essential to understand China’s hydrogen strategy, including how the country plans to start decarbonizing its current hydrogen consumption and expand future use and production. A notable feature of China’s hydrogen strategy is that it is not, in fact, singular, but instead comprised of a national strategy and a multitude of regional strategies. Since the release of China’s Medium and Long-Term Strategy for the Development of the Hydrogen Energy Industry (2021–2035) (referred to as “the National Plan”) in March 2022,2 there has been significant development in the country’s hydrogen space. However, the National Plan’s targets for renewable hydrogen production may appear conservative given the scale of hydrogen consumption in the country: a range of 100,000 to 200,000 tons per year by 2025 represents only 0.3 to 0.6 percent of the 33 million tons (Mt) of fossil-based hydrogen consumed in China in 2020.3 (For context, in 2022, electrolytic hydrogen’s production level was still below 100,000...