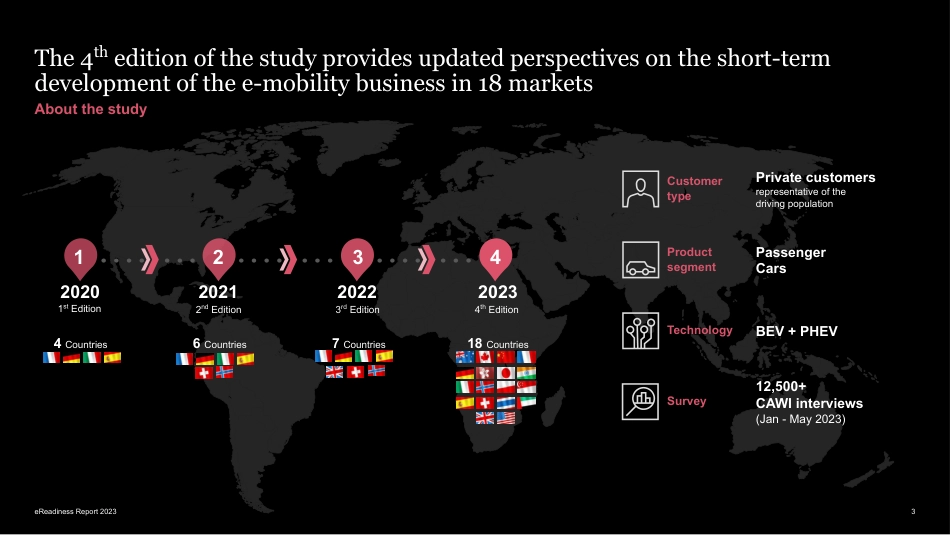

September 20234th editioneReadiness 2023Survey ReportCustomer needs and recommended actions for e-mobility playersAgenda201. Executive Summaryp.0502. Consumer viewpointsp.0702. - EV Ownersp.1302. - EV Prospectsp.4102. - EV Scepticsp.5703. eReadiness Indexp.6104. Recommendations on the way forwardp.78eReadiness Report 20231st Edition12342nd Edition3rd Edition4th Edition2020202120222023The 4th edition of the study provides updated perspectives on the short-term development of the e-mobility business in 18 marketsAbout the studyeReadiness Report 202334 Countries6 Countries7 Countries18 CountriesCustomertypeProduct segmentTechnologyPrivate customersrepresentative of the driving populationPassenger CarsBEV + PHEVSurvey12,500+CAWI interviews(Jan - May 2023)This year edition covers 18 countries across the globe,grouped into three regionseReadiness 2023 – Countries in scopeeReadiness Report 2023Source: Strategy&4AustraliaCanadaChinaFranceGermanyHong KongIndiaItalyJapanNorwayPolandThailandSpainSwitzerlandUAEUKUnited StatesSingaporeNorth AmericaEurope and Middle East Asia-PacificNAEMEAAPAC01.Executive SummaryeReadiness Report 20235Key insights from the consumer research sample Consumers demand•Consumers show a strong interest in e-mobility, with c. 30% of those surveyed disclosing an intention to buy an EV in the next 2 years •EV Owners (6% of the respondents) are mainly high-income, middle-aged males living in city centres with access to private parking spaces•EV Prospects (61% of the respondents) have ~20% less income than EV Owners. Of the 6 personas identified, Tech Enthusiasts, Dreamers and Pragmatic are the 3 determined to have the greatest intention of buying an EV and represent c. 70% of the demand in the next 2 years, suggesting that the EV market is ...