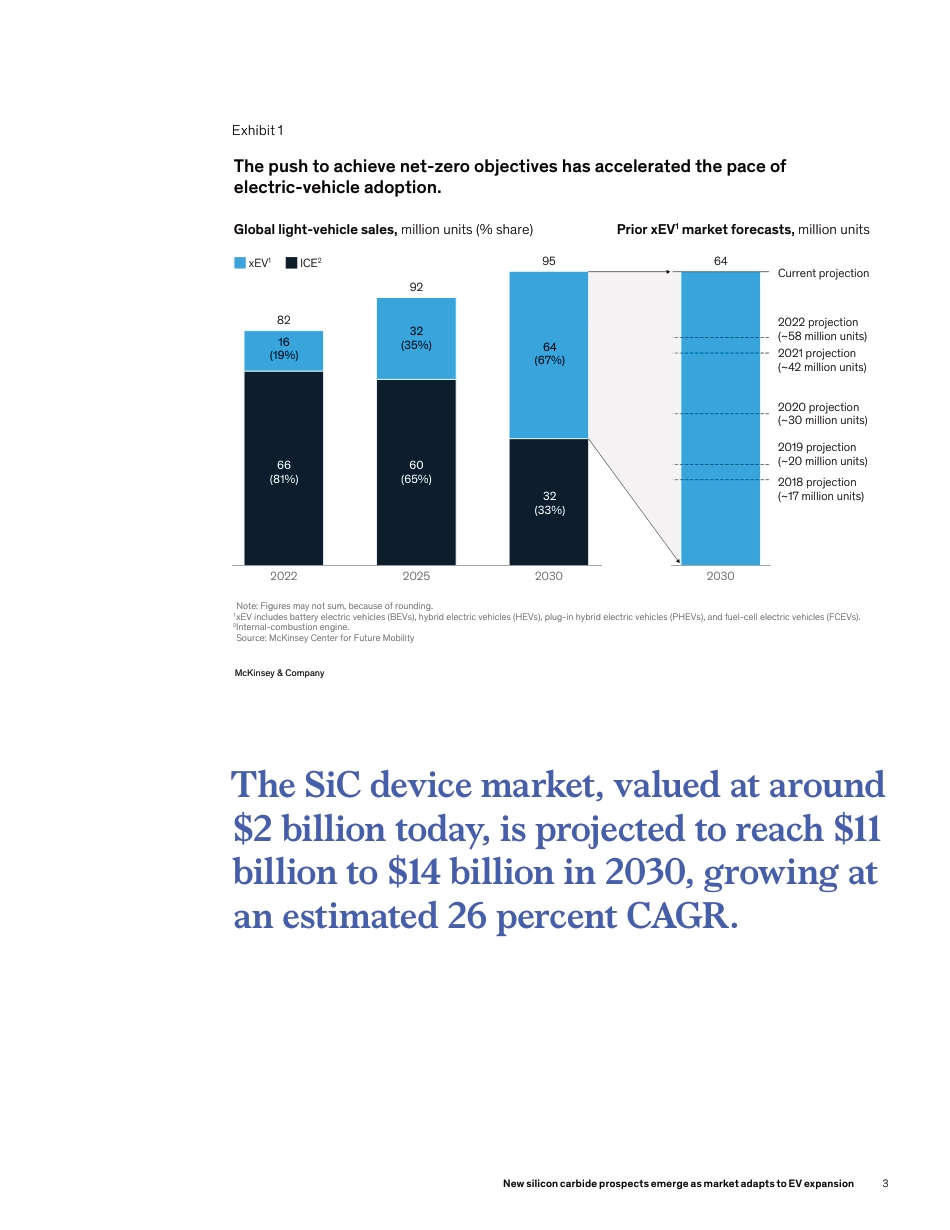

Semiconductor PracticeNew silicon carbide prospects emerge as market adapts to EV expansionRising electric-vehicle adoption is boosting demand for crucial silicon carbide power electronics components. How can semiconductor players, automotive OEMs, and others create value amid disruption?October 2023This article is a collaborative effort by Albert Brothers, Ondrej Burkacky, Julia Dragon, Jo Kakarwada, Abhijit Mahindroo, Jwalit Patel, and Anupama Suryanarayanan, representing views from McKinsey’s Semiconductor Practice.The electric-vehicle (EV) market is estimated to grow at a 20 percent CAGR through 2030, when sales of xEVs are estimated to reach 64 million—four times the estimated EV sales volume in 2022.1 Ensuring the EV component supply is sufficient to meet this rapid rise in estimated demand is critical, and the supply of silicon carbide (SiC) merits special consideration. Our analysis shows that compared to their silicon-based counterparts,2 SiC metal-oxide-semiconductor field-effect-transistors (MOSFETs)3 used in EV powertrains (primarily inverters, but also DC-DC converters and onboard chargers)4 provide higher switching frequency, thermal resistance, and breakdown voltage. These differences contribute to higher efficiency (extended vehicle range) and lower total system cost (reduced battery capacity and thermal management requirements) for the powertrain. These benefits are amplified at the higher voltages needed for battery electric vehicles (BEVs), which are expected to account for most EVs produced by 2030.In this article, we will examine how SiC manufacturers, automotive OEMs, and others can seize the oppor-tunities inherent in the projected EV market growth urge to create value and gain competitive advantages.1 Ba...