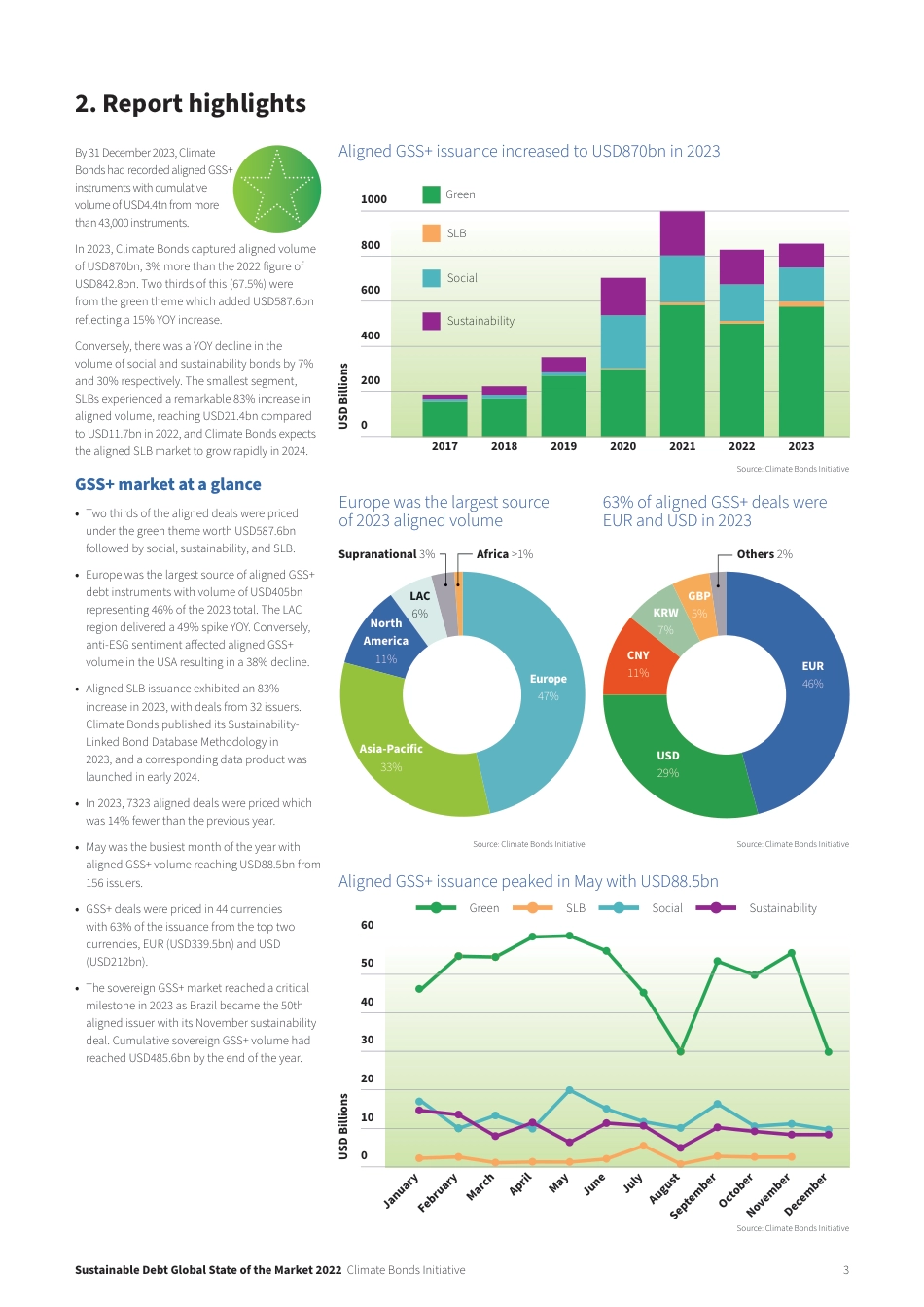

SUSTAINABLEDEBTGLOBALSTATEOFTHEMARKET2023Green$2.8tnSustainability$768bnSLB$47.2bnSocial$821bn$4.4tnCummulativeAlignedGSS+PreparedbyClimateBondsInitiativeSustainableDebtGlobalStateoftheMarket2023ClimateBondsInitiative21.IntroductionThisisthe13thiterationofClimateBondsInitiative’s(ClimateBonds)GlobalStateoftheMarketReport.Thescopeofthisreportincludesanalysisofgreen,social,andsustainability(GSS)bondsconsideredtobeinalignmentwithClimateBondsdatabasemethodologies(Appendix)plussustainability-linkedbonds(SLBs).Contents1.Introduction22.Reporthighlights33.Green54.Sustainability95.Social126.Sustainability-linkedbonds147.ThesovereignGSS+bondclub188.AdaptationandResilience209.Spotlight:Blue-labelledvolumeswellsin20232210.Policyspotlight2511.Outlook27Appendix28References30AlignedGSS+scorecardGreenSocialSustainabilitySLBAlignedGSS+Totalsizeofmarket(cumulative)USD2.8tnUSD821bnUSD768bnUSD48.6USD4.4tnNumberofcountries96496923106Numberofcurrencies5346431264AbouttheClimateBondsInitiativeClimateBondsisaninternationalorganisationworkingtomobiliseglobalcapitalforclimateaction.Itpromotesinvestmentinprojectsandassetsneededforarapidtransitiontoalow-carbon,climate-resilient,andfaireconomy.Themissionfocusistohelpdrivedownthecostofcapitalforlarge-scaleclimateandinfrastructureprojectsandtosupportgovernmentsseekingincreasedcapitalmarketsinvestmenttomeetclimateandgreenhousegas(GHG)emissionreductiongoals.ClimateBondsconductsmarketanalysisandpolicyresearch;undertakesmarketdevelopmentactivities;advisesgovernmentsandregulators;andadministersaglobalgreenbondStandardandCertificationscheme.ClimateBondsscreensgreenfinanceinstrumentsagainstitsglobalTaxonomytodeterminealignment,andsharesinformationaboutthecompositionofthismarketwithpartners.TheClimateBondsteamhasalsoexpandeditsanalysistootherthematicareas,suchassocialandsustainabilitybondsviathedevelopmentofscreeningmethodologiesforinvestmentsthatgiverisetopositivesocialimpactsandaddedresilience.CertificationagainsttheClimateBondsStandard(CBS)representsabout20%ofglobalgreenbondmarketvolumes.Thisschemeisunderpinnedbyrigorousscientificsector-specificCriteriatoensurethatCertifiedbondsandissuersareconsistentwiththewell-below2°CtargetoftheParisAgreement.ObtainingandmaintainingCertificationrequiresinitialandongoingthird-partyverificationtoensuretheassetsmeetthemetricsofsectorCriteria.ClimateBondsCertificationSchemeCertificationundertheClimateBondsStandardv4(CBSv4)goesbeyondUseofProceeds(UoP)instrumentstoincludenon-financialcorporateentitiesandtheirSLBs.LaunchedinApril2023,theCBSv4leveragesClimateBondstransparentscience-basedCriteriafornon-financialcorporateentities,credibleSLBsandsimilarinstruments,andprovidesassuranceforinvestorsthatsustainabilityrequirementshavebeenmetinrespectofanyCertifiedissuance.Thisworkgoesbeyondsectoraltransitionpathwaysandincludeskeygovernanceelementsthatindicateacompany’spreparednesstotransitiontonetzero.Certificationcanbeobtainedbycorporateswithemissionsalreadynearzeroaswellasthosewithactivitiesinhigh-emittingsectors,providingthecorporatehassuitablyambitiousperformancetargetsandcredibletransitionplans.CBSv4enablescorporatesalignedwith1.5-degreepathways,orthosethatwillbealignedby2030,toobtainCertification.SLBsissuedbyandinrespectoftheactivitiesofqualifyingnon-financialcorporatescanalsobeCertifiedundertheCBSv4.Bytheendof2023,ClimateBond...