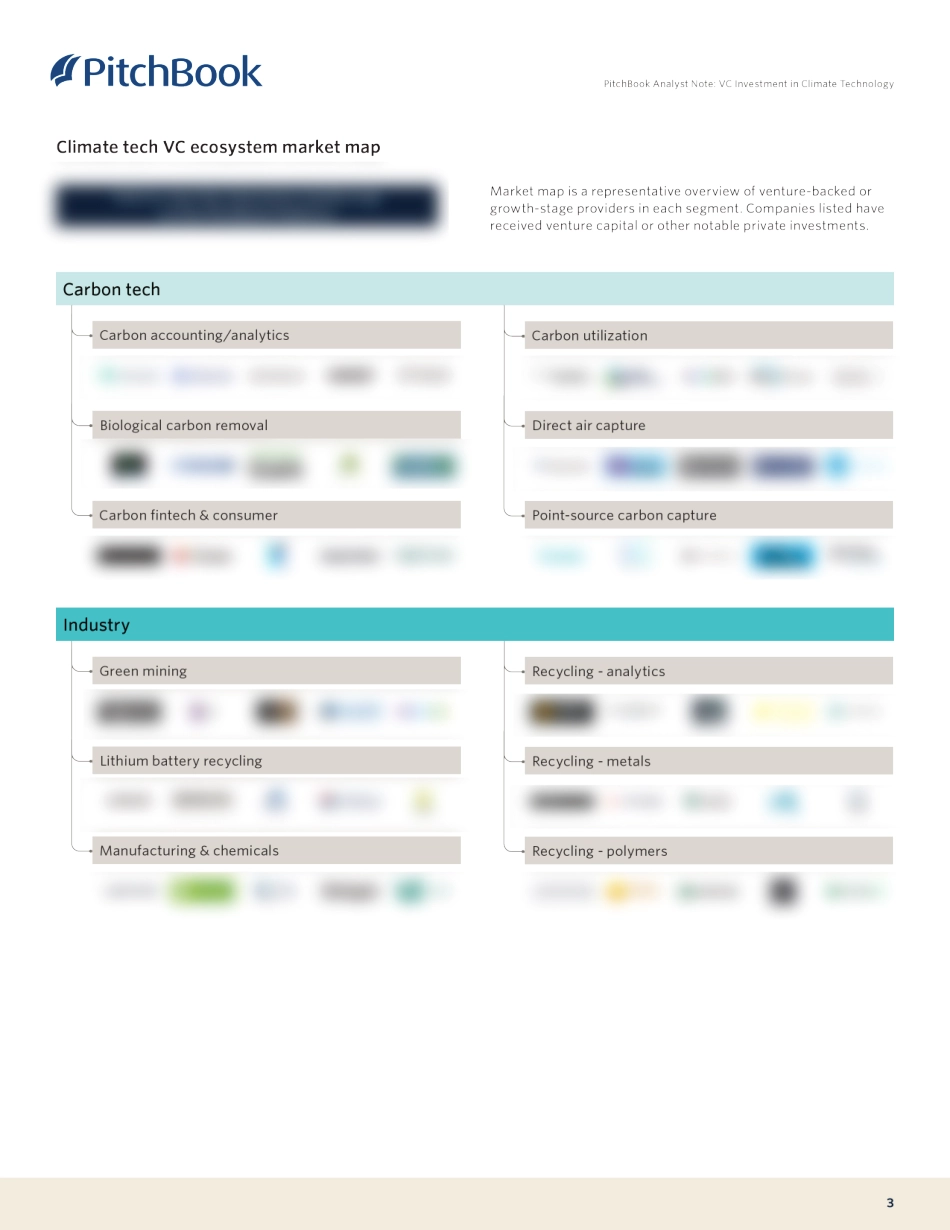

1PitchBook Data, Inc.John Gabbert Founder, CEONizar Tarhuni Vice President, Institutional Research and EditorialPaul Condra Head of Emerging Technology ResearchInstitutional Research GroupAnalysisKey takeaways1Introduction2Climate tech VC ecosystem market map3VC deal activity6Influencing factors for climate tech13Cross-sector climate tech trends 13ContentsPublished on June 20, 2023PublishingDesigned by Jenna O’MalleyDataAlyssa Williams Data Analystpbinstitutionalresearch@pitchbook.comPitchBook is a Morningstar company providing the most comprehensive, most accurate, and hard-to-find data for professionals doing business in the private markets.2022 VC investment in climate tech falls 15.0% from record year in 2021EMERGING TECH RESEARCHVC Investment in Climate TechnologyKey takeaways• Climate tech investment reached a peak in 2021 and fell slightly to $41.1 billion in 2022, likely due to more challenging economic conditions affecting the overall VC space.• Key drivers of climate tech investment remain strong, including regulation and policy, consumer interest, corporate net-zero targets, and investor pressure.• Within the climate tech space, electric vehicles, power grid infrastructure, industrial decarbonization, and intermittent renewable energy sources (solar and wind) raised the most VC funding in 2022.• Many technologies within climate tech have implications across sectors, allowing technological and production developments in one area to benefit multiple use cases: for example, developments in battery technology benefiting BEVs, utility-scale energy storage, and residential battery installations.John MacDonagh Senior Analyst, Emerging Technologyjohn.macdonagh@pitchbook.com2PitchBook Analyst Note: VC Investment in Climate TechnologyIntroductionSince...