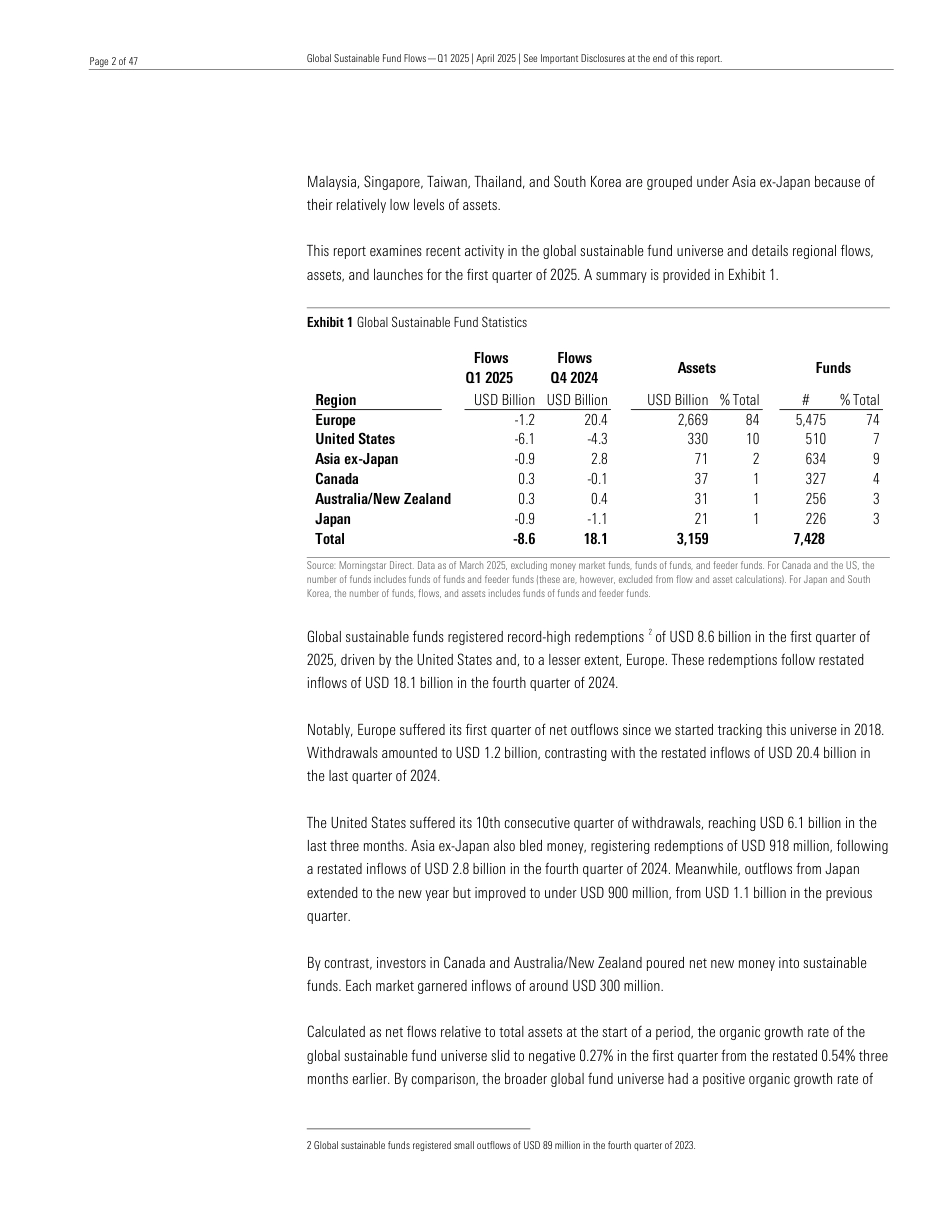

Global Sustainable Fund Flows: Q1 2025 in Review Record-high outflows amid new geopolitical challenges and an intensifying ESG backlash. Key Takeaways × Global sustainable open-end and exchange-traded funds experienced record-high outflows in the first quarter of 2025 amid new geopolitical challenges and an intensifying environmental, social, and governance backlash. Investors withdrew an estimated USD 8.6 billion, contrasting with the restated inflows of USD 18.1 billion in the previous quarter. × Europe suffered its first quarter of net outflows since at least 2018. Redemptions amounted to about USD 1.2 billion, contrasting with the restated inflows of USD 20.4 billion in the last quarter of 2024. × Investors in the United States pulled money from sustainable funds for the 10th consecutive quarter, with withdrawals reaching USD 6.1 billion. Asia also bled money, while Canada and Australia/New Zealand attracted net new money. × Global sustainable fund assets slid marginally to USD 3.16 trillion at the end of March, reflecting weakness in the US equity market. × Product development slowed further, with 54 new sustainable funds launched globally over the quarter. × Rebranding activity accelerated. In Europe, 335 sustainable products changed names, including 116 that dropped ESG-related terms, ahead of the EU's antigreenwashing rules related to fund names. × About 94 European products were liquidated or merged, while US fund closures reached a new quarterly high of 20. × In the UK, 94 funds have so far adopted an official sustainability label, representing USD 47 billion of assets. These account for 20% of UK-domiciled funds claiming sustainability characteristics. × ESG investors are navigating a com...