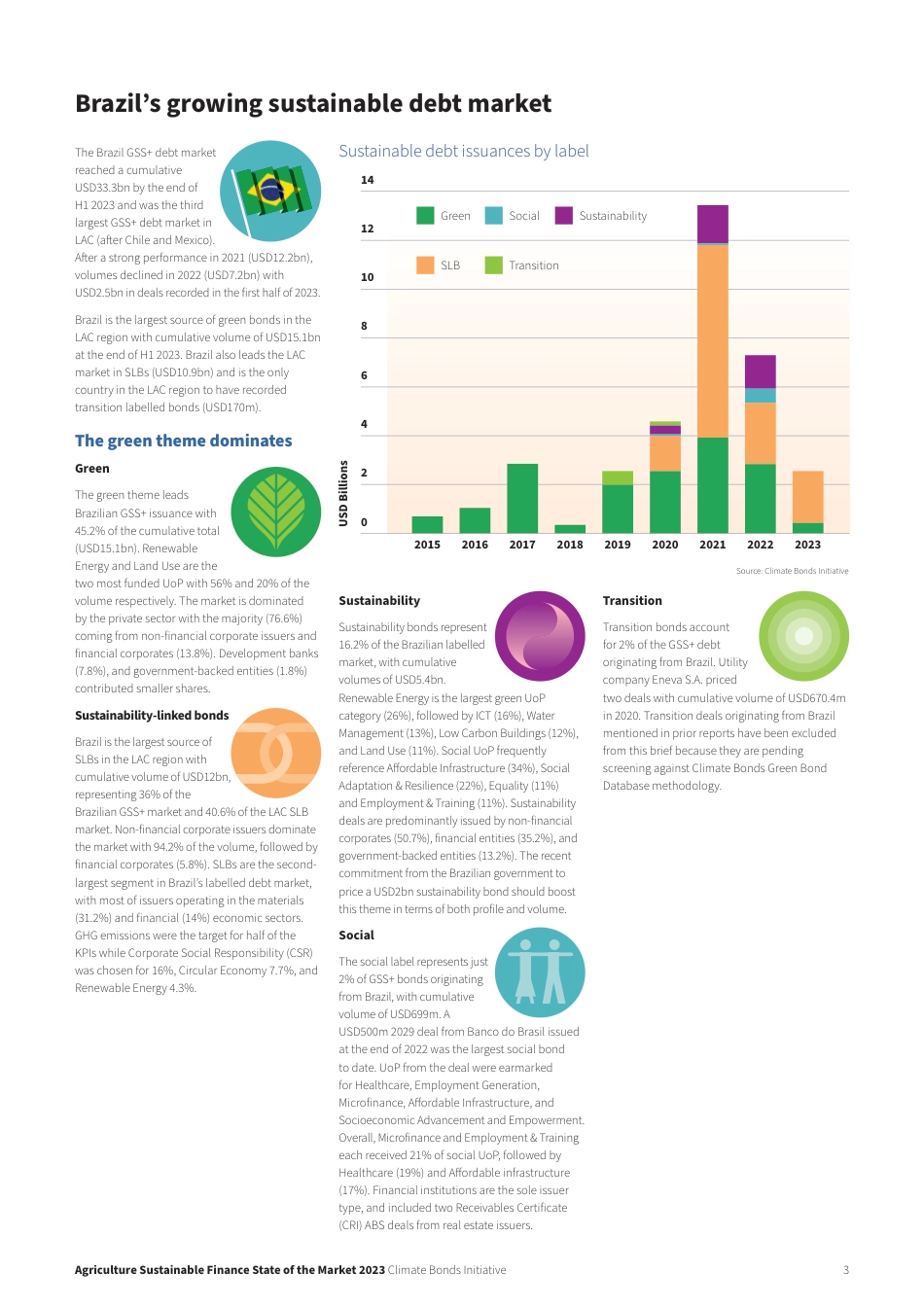

Agriculture Sustainable Finance State of the Market 2023 Brazil briefing paperPrepared by the Climate Bonds Initiative Supported by the Gordon and Betty Moore FoundationAgriculture Sustainable Finance State of the Market 2023 Climate Bonds Initiative 2Brazilian agriculture, including livestock and agricultural activities, was responsible for 9.8% of the global agricultural sector emissions in 2022.1 Given that methane is its largest source of greenhouse gas (GHG) emissions, Brazil is the fifth largest emitter globally with 91.6% coming from enteric fermentation of cattle.2 Consequently, dealing with the environmental impacts of agri-food systems plays a pivotal role in the country’s transition to net zero, both in terms of climate change mitigation and adaptation.The growth of the agriculture sector in Brazil has resulted in deforestation and change of land use, which has also increased domestic GHG emissions.3 The sector, including production and agribusiness supply chains, now accounts for nearly 25% of the economy. Despite climatic adversities and the global economic impact of the pandemic, the sector has shown resilience accounting for a fifth of GDP growth in the Q1 2023, boosted by delayed harvests.4,5Sustainable finance is playing an increasingly important role in the decarbonisation of the agricultural sector. By the end of H1 2023, the Brazilian sustainable debt market had Thematic labelsGreen, social, sustainability and transitionGreen, social, sustainability, and transition bonds offer climate and social benefits through their UoP. The proceeds from the sale of such bonds are earmarked to support climate or social expenditures in categories specified in the issuer’s sustainable financing framework. Green ...