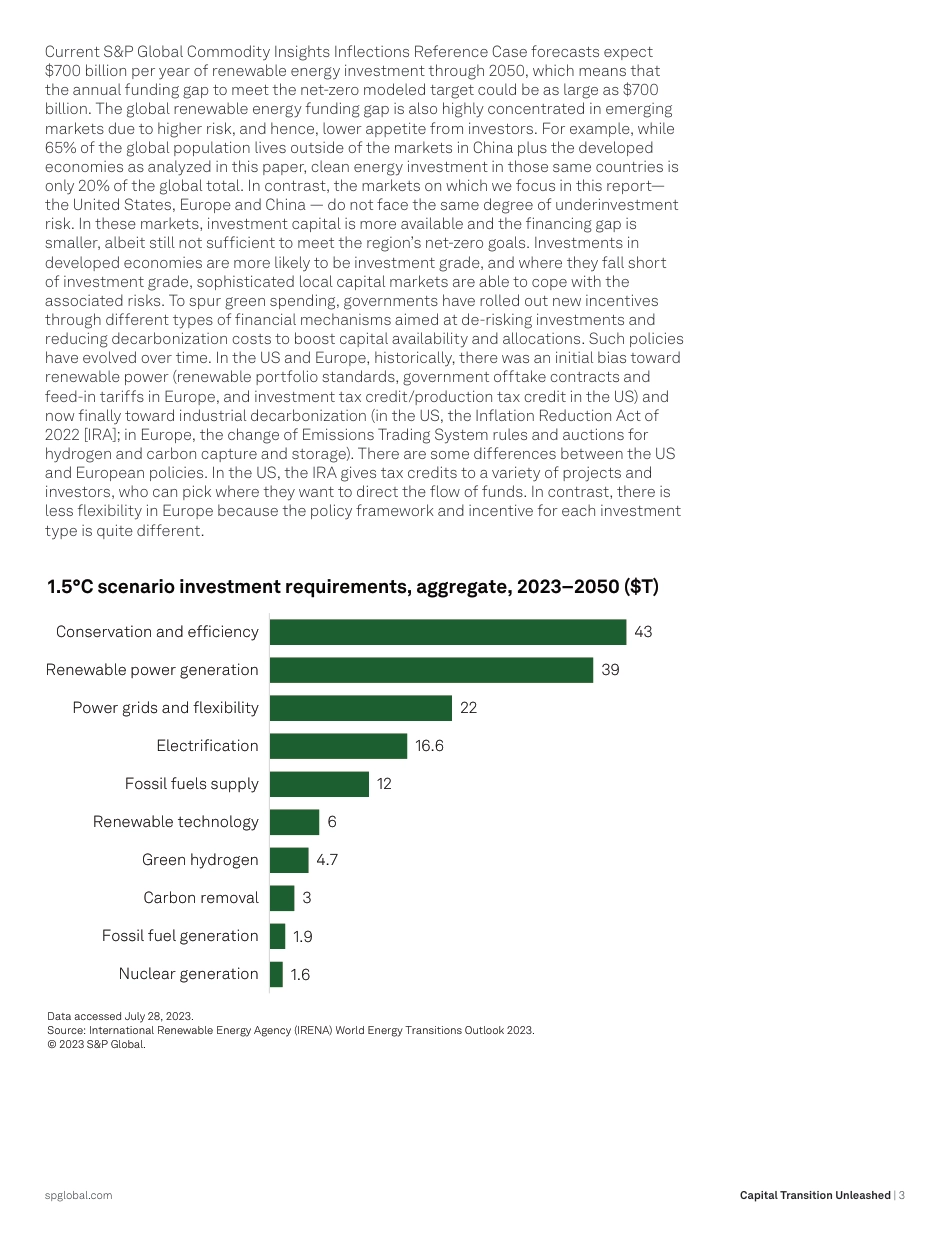

Renewable Energy Funding in 2023: A “Capital Transition” UnleashedSeptember 2023spglobal.com | © 2023 S&P Global. All rights reserved.This article, by S&P Global Ratings and S&P Global Commodity Insights, is a thought leadership report that neither addresses views about individual ratings nor is a rating action. S&P Global Ratings and S&P Global Commodity Insights are separate and independent divisions of S&P Global.Capital Transition Unleashed | 2Key Takeaways1. International Renewable Energy Agency (IRENA) World Energy Transitions Outlook 2023, www.irena.org.– Many governments around the world have been making progress mobilizing public and private capital to accelerate the energy transition, with significant money inflows into projects in recent years. These inflows are necessary to meet the tripling of funding needs for low-carbon projects across sectors by 2030 to meet 2050 net-zero goals.– These inflows are particularly pronounced in the United States, China and the European Union – responding to high-level policy goals, yet executed through distinctive financing channels. These achievements, however, still fall short of what is needed to meet net-zero greenhouse gas emissions goals as laid out in the Paris Agreement – particularly given lower activity outside these key regions. – We see capital flows currently strongly favoring renewable power generating assets, namely wind and solar, with less focus on, for example, transmission and storage. This dislocation between policy intent and current investment is likely to result in integration bottlenecks and dysfunctioning energy markets unless market design evolves quickly. – Adapting policies and regulations also comes with risks for developers and investor...