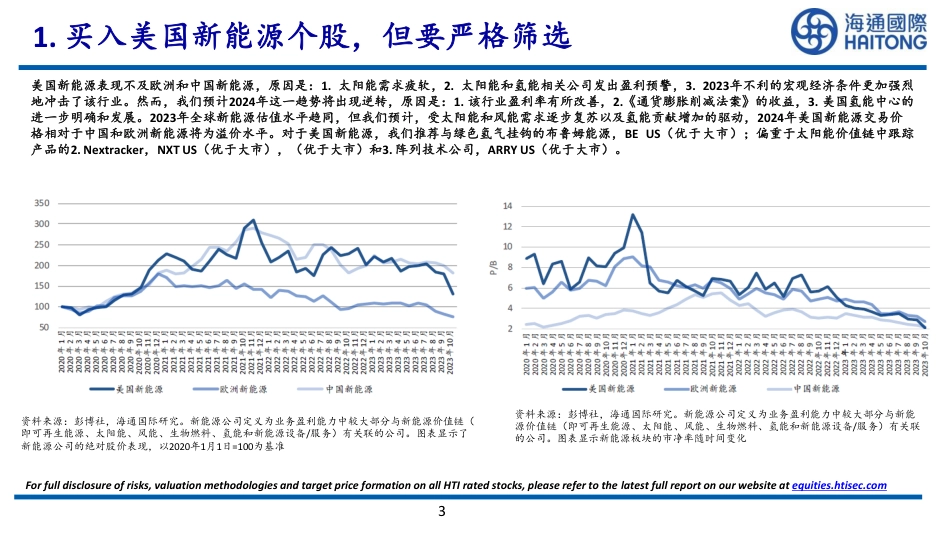

《全球能源展望2024:美国新能源复苏,但需择优入市》Scott Darling, scott.darling@htisec.comAxel Leven, axel.leven@htisec.com2024年1月4日Equity – Asia ResearchThis research report is distributed by Haitong International, a global brand name for the equity research teams of Haitong International Research Limited (“HTIRL”),Haitong Securities India Private Limited (“HSIPL”), Haitong International (Japan) K.K.(“HTIJKK”), Haitong International Securities Company Limited (“HTISCL”), and anyother members within the Haitong International Securities Group of Companies (“HTISG”), each authorized to engage in securities activities in its respectivejurisdiction. Please refer to the appendix for the Analyst Certification, Important Disclosures and Important Disclaimer.2For full disclosure of risks, valuation methodologies and target price formation on all HTI rated stocks, please refer to the latest full report on our website at equities.htisec.com全球传统能源(即以化石燃料为主)和全球新能源(即以可再生能源为主)价值链内的10个主要投资思路31. 买入美国新能源个股,但要严格筛选美国新能源表现不及欧洲和中国新能源,原因是:1. 太阳能需求疲软,2. 太阳能和氢能相关公司发出盈利预警,3. 2023年不利的宏观经济条件更加强烈地冲击了该行业。然而,我们预计2024年这一趋势将出现逆转,原因是:1. 该行业盈利率有所改善,2.《通货膨胀削减法案》的收益,3. 美国氢能中心的进一步明确和发展。2023年全球新能源估值水平趋同,但我们预计,受太阳能和风能需求逐步复苏以及氢能贡献增加的驱动,2024年美国新能源交易价格相对于中国和欧洲新能源将为溢价水平。对于美国新能源,我们推荐与绿色氢气挂钩的布鲁姆能源,BE US(优于大市);偏重于太阳能价值链中跟踪产品的2. Nextracker,NXT US(优于大市),(优于大市)和3. 阵列技术公司,ARRY US(优于大市)。For full disclosure of risks, valuation methodologies and target price formation on all HTI rated stocks, please refer to the latest full repor...