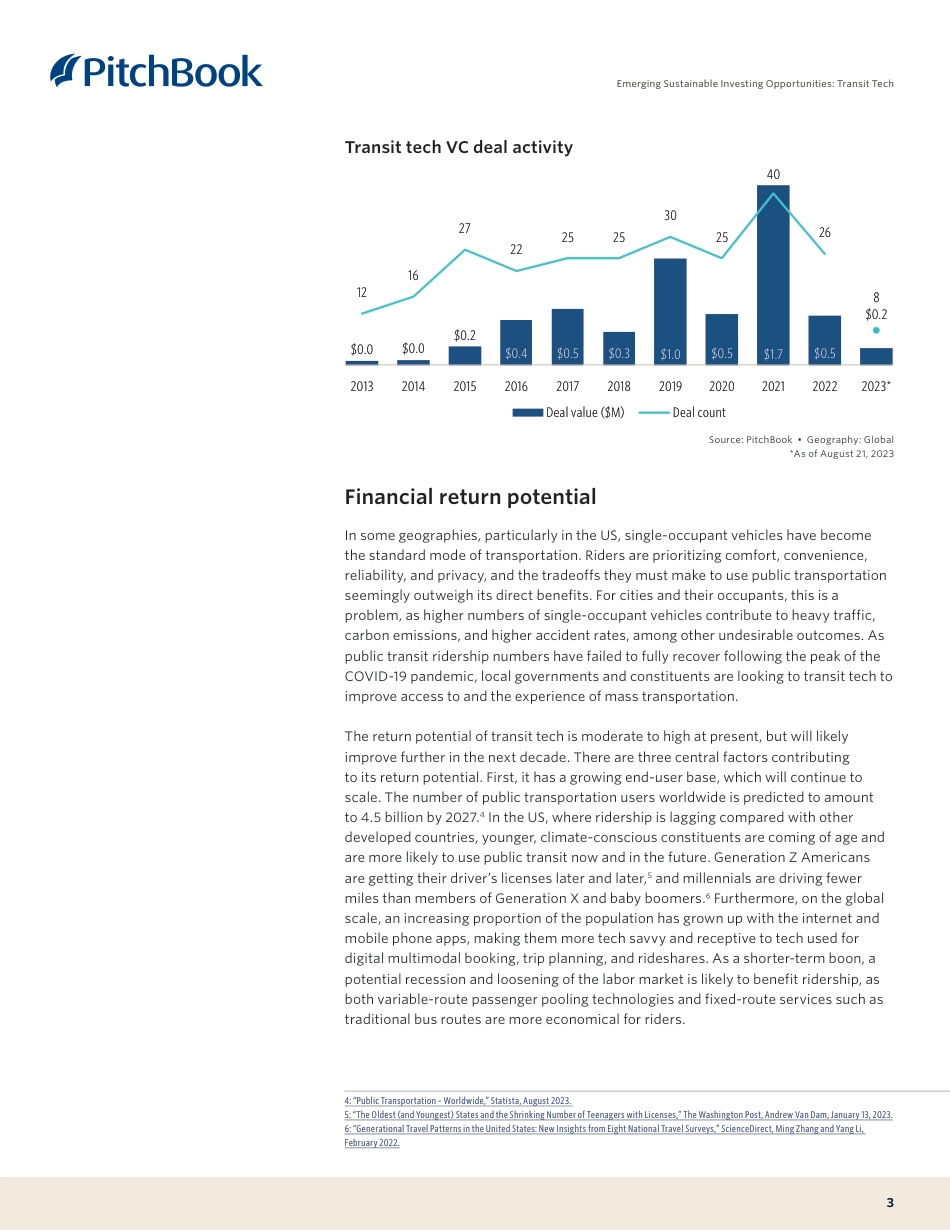

1Institutional Research GroupAnalysisPitchBook Data, Inc.John Gabbert Founder, CEONizar Tarhuni Vice President, Institutional Research and EditorialDaniel Cook, CFA Head of Quantitative ResearchContentsPublished on September 22, 2023PublishingDesigned by Chloe LadwigKey takeaways1Introduction2Financial return potential3Environmental and social impact potential5PitchBook is a Morningstar company providing the most comprehensive, most accurate, and hard-to-find data for professionals doing business in the private markets.How transit tech can create a double bottom line of financial returns and positive social and environmental impact Emerging Sustainable Investing Opportunities: Transit TechKey takeaways• In an effort to boost public transit ridership numbers, governments are increasingly turning to transit tech to help improve both access to and the experience of mass transportation. • The financial return potential of this opportunity is underpinned by a growing end-user base, government support in the form of partnerships and regulatory cooperation, and user stickiness. • Transit tech has the potential to create positive environmental impacts in the areas of climate change and pollution mitigation and ecosystem harm prevention, as well as social impacts in terms of human health and economic mobility.Anikka Villegas Analyst, Fund Strategies & Sustainable Investinganikka.villegas@pitchbook.comDataAlyssa Williams Senior Data Analystpbinstitutionalresearch @pitchbook.comInsights developed in collaboration with Jonathan Geurkink, Sr. Analyst, Emerging Technology at PitchBook Data.2Emerging Sustainable Investing Opportunities: Transit TechIntroductionVenture capital, often serving as the incubator of emerging technologies, is well-positioned to invest w...