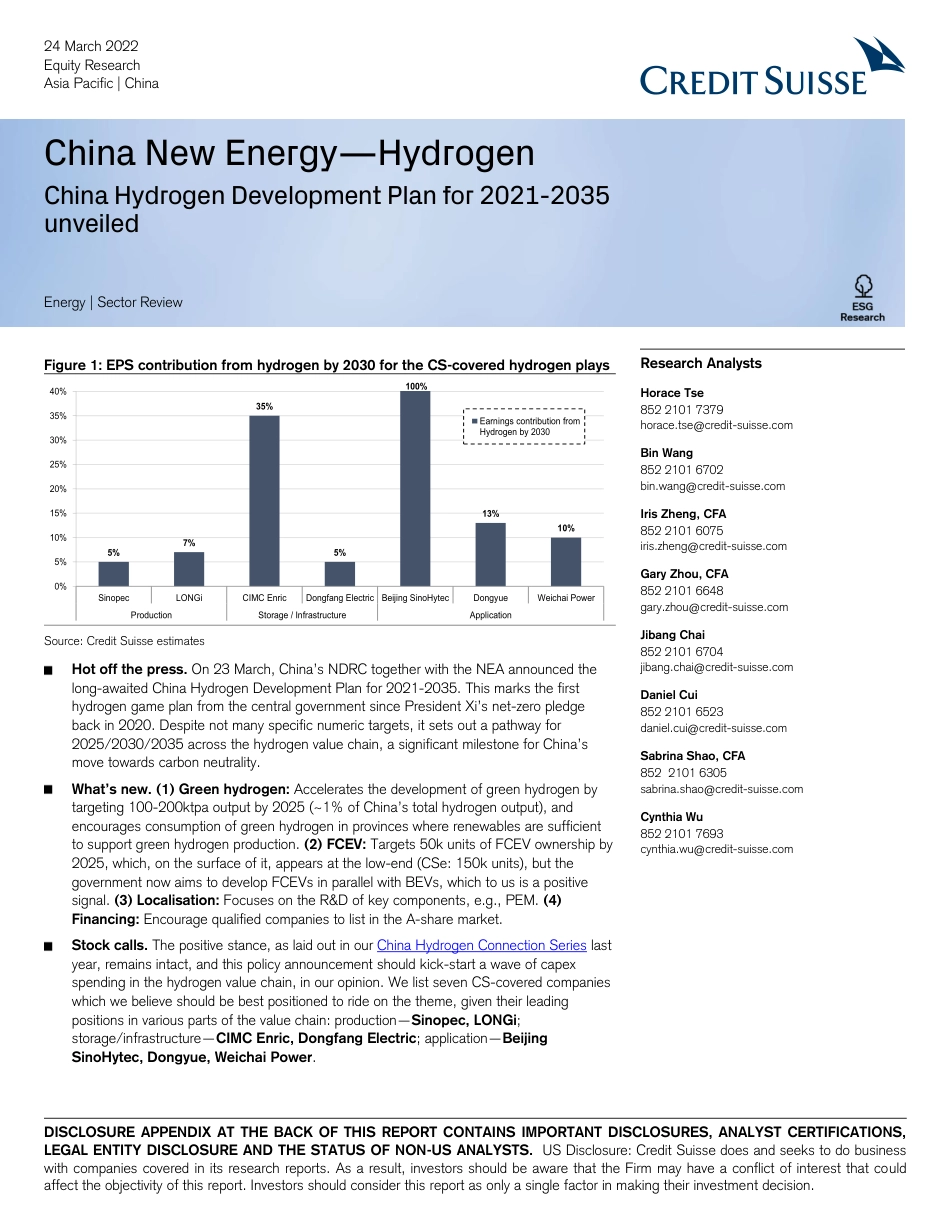

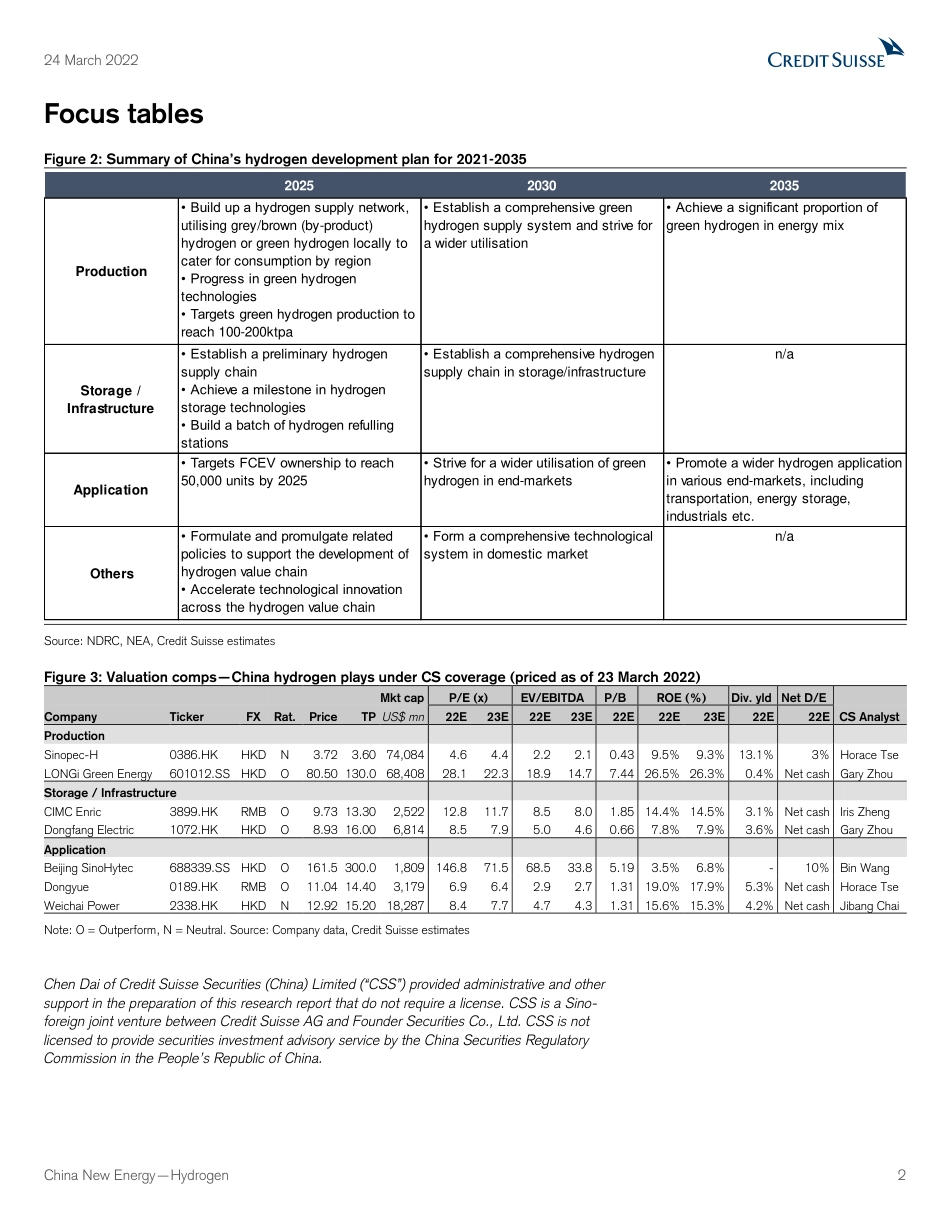

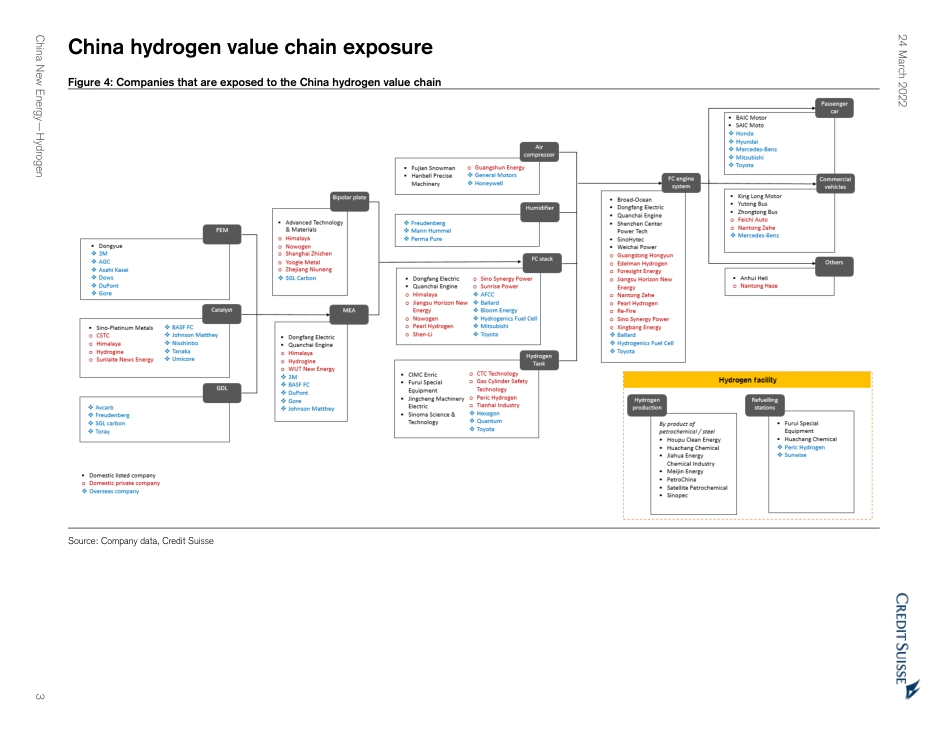

China New Energy—Hydrogen China Hydrogen Development Plan for 2021-2035 unveiled Energy | Sector Review Figure 1: EPS contribution from hydrogen by 2030 for the CS-covered hydrogen plays Source: Credit Suisse estimates Hot off the press. On 23 March, China’s NDRC together with the NEA announced the long-awaited China Hydrogen Development Plan for 2021-2035. This marks the first hydrogen game plan from the central government since President Xi’s net-zero pledge back in 2020. Despite not many specific numeric targets, it sets out a pathway for 2025/2030/2035 across the hydrogen value chain, a significant milestone for China’s move towards carbon neutrality. What’s new. (1) Green hydrogen: Accelerates the development of green hydrogen by targeting 100-200ktpa output by 2025 (~1% of China’s total hydrogen output), and encourages consumption of green hydrogen in provinces where renewables are sufficient to support green hydrogen production. (2) FCEV: Targets 50k units of FCEV ownership by 2025, which, on the surface of it, appears at the low-end (CSe: 150k units), but the government now aims to develop FCEVs in parallel with BEVs, which to us is a positive signal. (3) Localisation: Focuses on the R&D of key components, e.g., PEM. (4) Financing: Encourage qualified companies to list in the A-share market. Stock calls. The positive stance, as laid out in our China Hydrogen Connection Series last year, remains intact, and this policy announcement should kick-start a wave of capex spending in the hydrogen value chain, in our opinion. We list seven CS-covered companies which we believe should be best positioned to ride on the theme, given their leading positions in various parts of the value chain: produ...