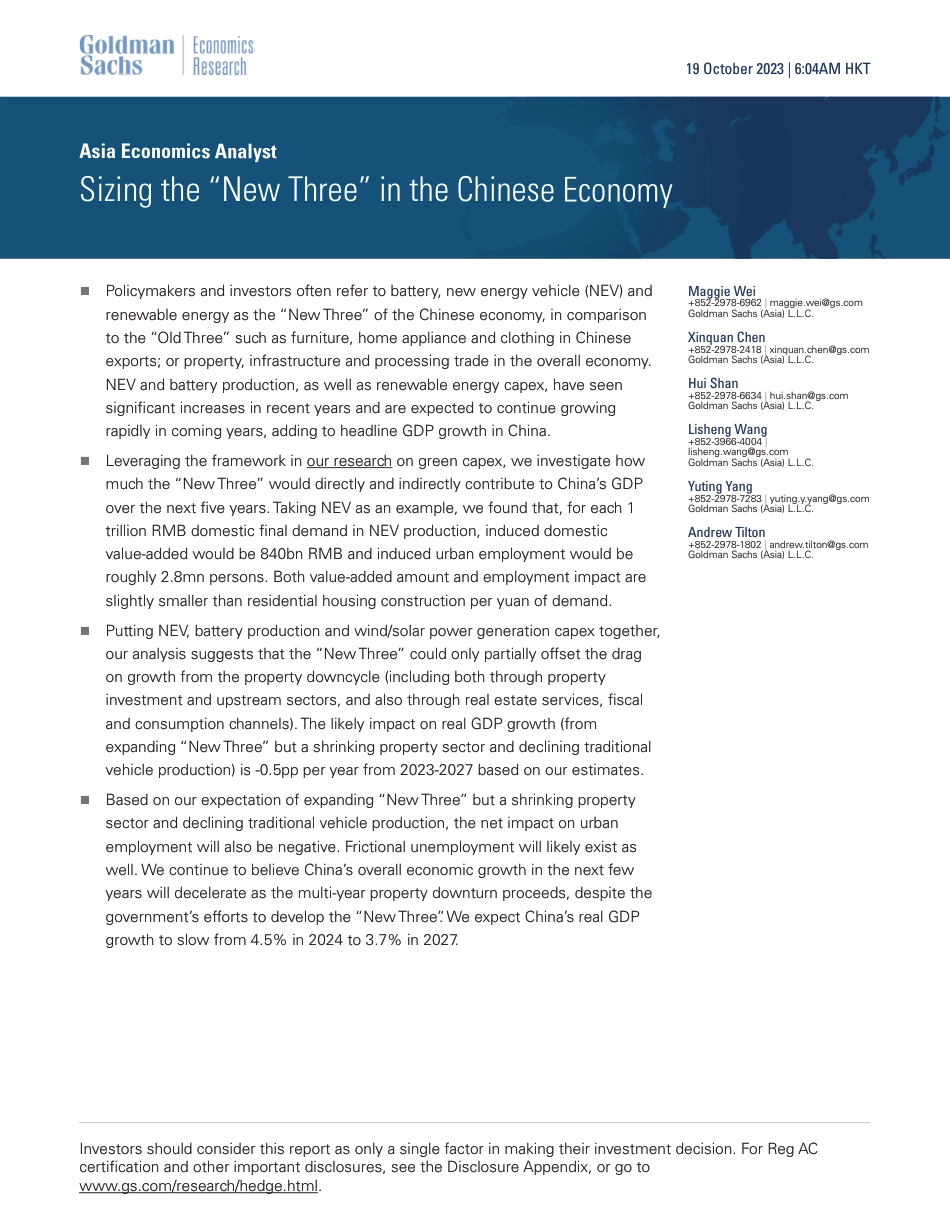

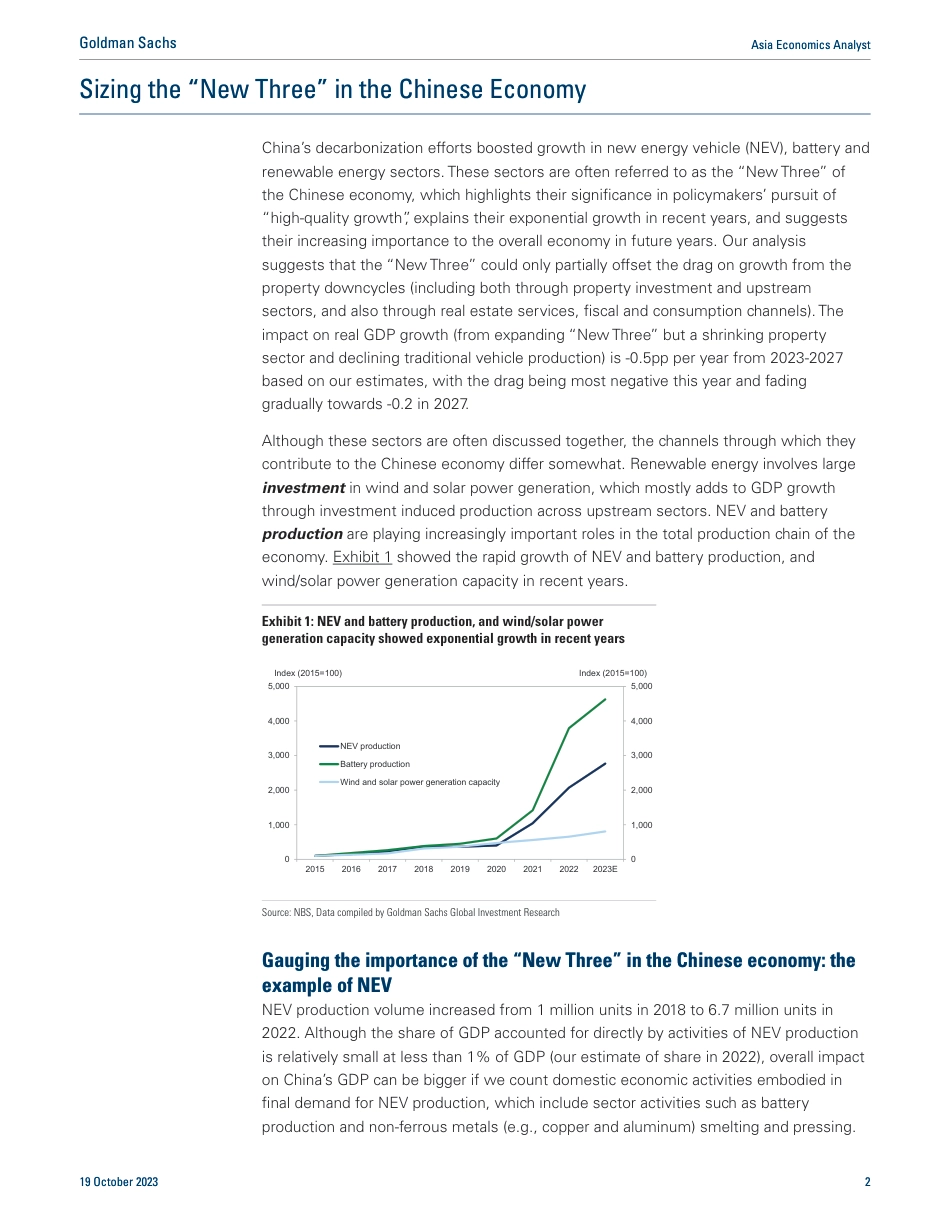

Policymakers and investors often refer to battery, new energy vehicle (NEV) andnrenewable energy as the “New Three” of the Chinese economy, in comparisonto the “Old Three” such as furniture, home appliance and clothing in Chineseexports; or property, infrastructure and processing trade in the overall economy.NEV and battery production, as well as renewable energy capex, have seensignificant increases in recent years and are expected to continue growingrapidly in coming years, adding to headline GDP growth in China.Leveraging the framework in our research on green capex, we investigate hownmuch the “New Three” would directly and indirectly contribute to China’s GDPover the next five years. Taking NEV as an example, we found that, for each 1trillion RMB domestic final demand in NEV production, induced domesticvalue-added would be 840bn RMB and induced urban employment would beroughly 2.8mn persons. Both value-added amount and employment impact areslightly smaller than residential housing construction per yuan of demand.Putting NEV, battery production and wind/solar power generation capex together,nour analysis suggests that the “New Three” could only partially offset the dragon growth from the property downcycle (including both through propertyinvestment and upstream sectors, and also through real estate services, fiscaland consumption channels). The likely impact on real GDP growth (fromexpanding “New Three” but a shrinking property sector and declining traditionalvehicle production) is -0.5pp per year from 2023-2027 based on our estimates.Based on our expectation of expanding “New Three” but a shrinking propertynsector and declining traditional vehicle production, the net impact on urbanemployment will also be...