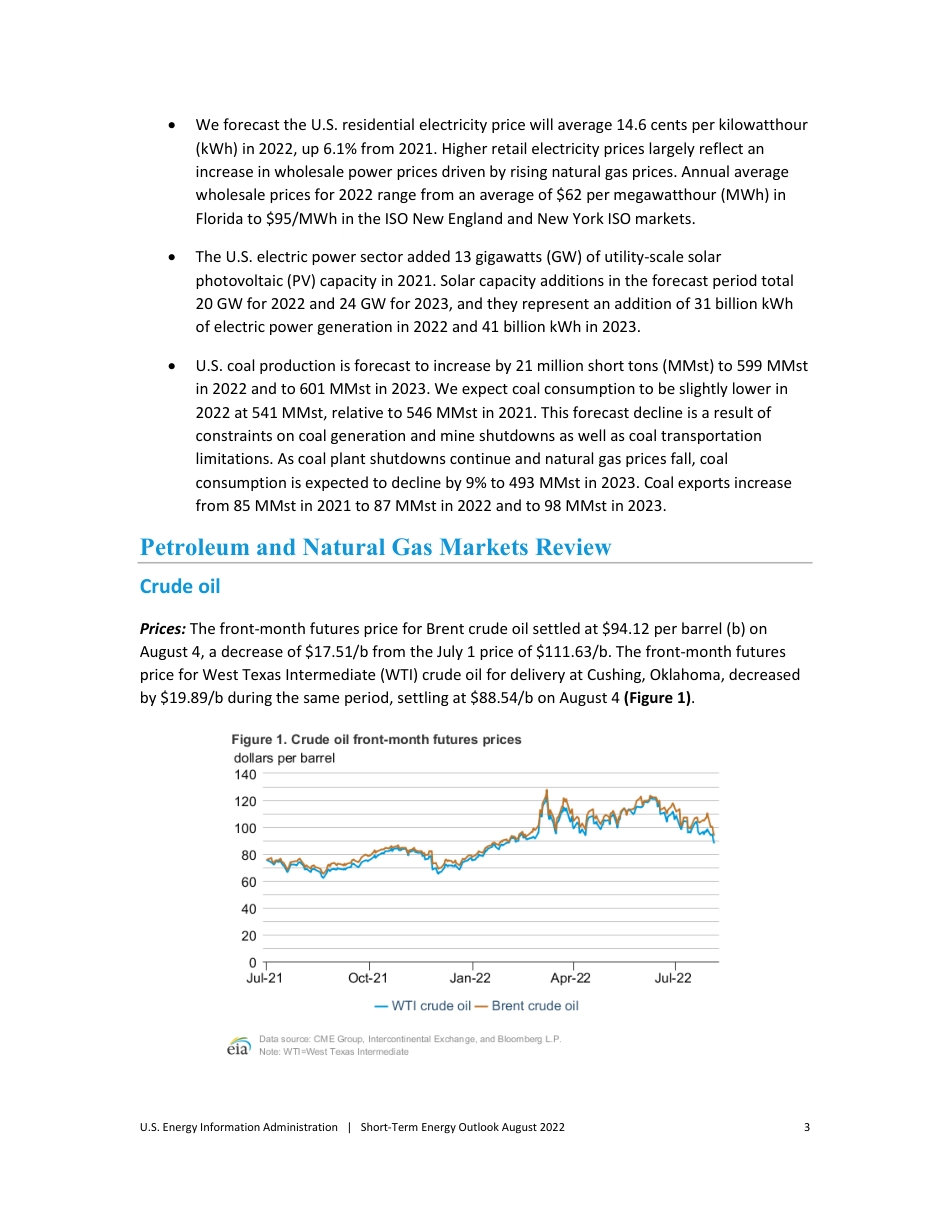

U.S. Energy Information Administration | Short-Term Energy Outlook August 2022 1 Note: EIA completed modeling and analysis for this report on Thursday, August 4, 2022 August 2022 Short-Term Energy Outlook Forecast highlights Global liquid fuels• The August Short-Term Energy Outlook (STEO) is subject to heightened uncertainty resulting from Russia’s full-scale invasion of Ukraine, how sanctions affect Russia’s oil production, the production decisions of OPEC+, the rate at which U.S. oil and natural gas production rises, and other contributing factors. Less robust economic activity in our forecast could result in lower-than-forecast energy consumption. • We forecast the spot price of Brent crude oil will average $105 per barrel (b) in 2022 and $95/b in 2023. • U.S. crude oil production in our forecast averages 11.9 million barrels per day (b/d) in 2022 and 12.7 million b/d in 2023, which would set a record for most U.S. crude oil production in a year. The current record is 12.3 million b/d, set in 2019. • We estimate that 98.8 million b/d of petroleum and liquid fuels was consumed globally in July 2022, an increase of 0.9 million b/d from July 2021. We forecast that global consumption of petroleum and liquid fuels will average 99.4 million b/d for all of 2022, which is a 2.1 million b/d increase from 2021. We forecast that global consumption of petroleum and liquid fuels will increase by another 2.1 million b/d in 2023 to average 101.5 million b/d. • The U.S. retail price for regular grade gasoline averaged $4.56 per gallon (gal) in July, and the average retail diesel price was $5.49/gal. We expect retail gasoline prices to average $4.29/gal in the third quarter of 2022 (3Q22) and fa...